If you’re thinking of selling your home, you no longer have to worry about a low-priced foreclosure or short sale brining down your value.

If you’re an active buyer looking for a home in Orange or Los Angeles Counties, there’s a good chance that almost 100% of the homes you’ve viewed in person are traditional equity sales. You might have even viewed a few brand new communities.

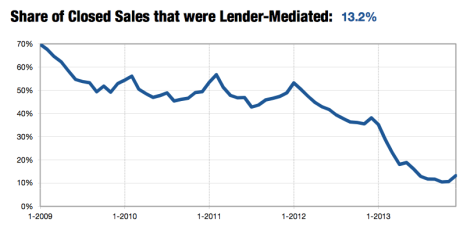

At one point, “lender mediated sales”, or homes that were a short sale, REO, or required some lender involvement, soared to over 70% of homes on the market.

Gone are the days of viewing smelly, abandoned homes where submitting & negotiating an offer was challenging as registering for one of the exchanges for Affordable Health Care. Today, just about every home my clients want need an appointment with the seller and will attract multiple offers. If there aren’t multiple offers on an attractive home, it’s either overpriced or something is very wrong with the home.

Why am I seeing so many foreclosures online?

As mentioned on a prior blog, websites shouldn’t be considered reliable resources for finding a home. Their main objective is to drive traffic to their site to attract advertisers. In the example shown above, there were 84 foreclosures shown on the report.

Only ONE of them were available for sale.

The rest of them consist of homes that had “foreclosure activity” recorded on public record. This could consist of the lender issuing a Notice of Default, Notice of Trustee Sale (auction), or a home being foreclosed. Keep in mind that even during the peak of the foreclosure market, only 2-5 homes out of 100 that were auctioned actually resulted in a home for sale to the open market.

As written in a prior blog, there are many factors at work here. Banks aren’t “holding off” on foreclosures.

Look for foreclosure activity to remain flat over the next 2-3 years. While there are still a significant number of homeowners who are underwater, there are too many options for them to keep their home. Additionally, motivation to hang on will remain strong as long as prices continue rising or remain flat.